michigan property tax rates by zip code

Michigans 2016 average taxable value for a residential parcel was 52120 and the average millage rate for an owner-occupied home was 3455. You can sort by any column available by clicking the arrows in the header row.

How To Calculate Michigan Property Taxes On Your Investment Properties

Ad Get In-Depth Property Tax Data In Minutes.

. West Bloomfield Township Oakland County. Median property tax is 214500. In the city of Kalamazoo the tax rate on principal residences is anywhere from 4813 to 5033 mills.

Property Tax Forfeiture and Foreclosure. Heres a breakdown of some of the most common property tax exemptions. This western Michigan County has an effective property tax rate 173 that ranks among the highest in Michigan.

United states number of homes. Michigan property tax rates by zip code real estate. The following cities levy an income tax at different rates.

You can look up your recent appraisal by filling out the form below. The michigan property tax rates by zip code and lower than other financial assistance from. Estimate Your Property Taxes Millage Rate Information.

2021-2022 Statutory Tax Collection Distribution Calendar. Looking to receive more flexible than taxes by property tax rates but received. Search Valuable Data On A Property.

Present the certificate to the seller at crunch time with purchase. In 2019 the city of Dearborn Heights in Wayne County had a millage rate that ranged from 594 for homes in Dearborn schools 549 in Dearborn Heights. Estimated combined tax rate 600 estimated county tax rate 000 estimated city tax rate 000 estimated.

2022 Property Tax Calendar. West Bloomfield Township had a total taxable value of 3561180050 in 2018 of which 89 is residential property. Property Tax Calculator - Estimate Any Homes Property Tax.

Type and hit enter Type and hit enter. A sample of the 1153 Michigan state sales tax rates in our database is provided below. The median property tax in Michigan is 214500 per year based on a median home value of 13220000 and a median effective property tax rate of 162.

Most states and counties include certain property tax exemptions beyond the full exemptions granted to religious or nonprofit groups. The tax data is broken down by zip code and additional locality information location population etc is also included. The median property tax in wayne county michigan is 2506 per year for a home.

Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records. Information regarding personal property tax including forms exemptions and information for taxpayers and assessors regarding the Essential Services Assessment. The average combined rate of every zip code in michigan is 6.

Homes in Kalamazoo County have a median value of 153800. Apply for discovering comps michigan property tax by zip code enforced school operating as your tax than. Tax amount varies by county.

The list is sorted by median property tax in dollars by default. This interactive table ranks Michigans counties by median property tax in dollars percentage of home value and percentage of median income. Miscellaneous Taxes and Fees.

Pontiac Port Huron Portland Springfield and Walker. United states number of homes. If you need to find out the.

Start Your Homeowner Search Today. Average 2016 property tax bill for for residential parcels in Wayne-Westland schools billed at homestead millage rate. The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes and millage rates with.

Michigan General Property Tax Act. Ad Get In-Depth Property Reports Info You May Not Find On Other Sites. The median property tax in michigan is 214500 per year for a home worth the median value of 13220000.

For 2021 the following Michigan cities levy an income tax of 1 on residents and 05 on nonresidents. Average was 884 for other school districts. 594 to 477 mills.

The Michigan Treasury Property Tax Estimator page will experience possible downtime on Thursday from 3PM to 4PM due to scheduled maintenance. Total taxable value. Our dataset includes all local sales tax jurisdictions in Michigan at state county city and district levels.

Such As Deeds Liens Property Tax More. What Are Property Tax Exemptions. 2020 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP Lee Twp 031120 ALLEGAN PUBLIC SCHOOL 317465 497465 257465 377465 357465 537465 FENNVILLE PUBLIC SCHO 286041 466041 226041 346041 326041 506041 BLOOMINGDALE PUBLIC S 310193 489689 250193 369689 350193 529689 Leighton Twp 031130.

Sales tax and use tax rate of zip code 48144 is located in lambertville city monroe county michigan state.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Best Places To Live In Troy Zip 48098 Michigan

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

50 Communities With Michigan S Highest Property Tax Rates Mlive Com

Michigan Property Tax H R Block

Livonia Michigan Property Taxes

Redford Township Government Departments Assessor About The Assessing Office

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

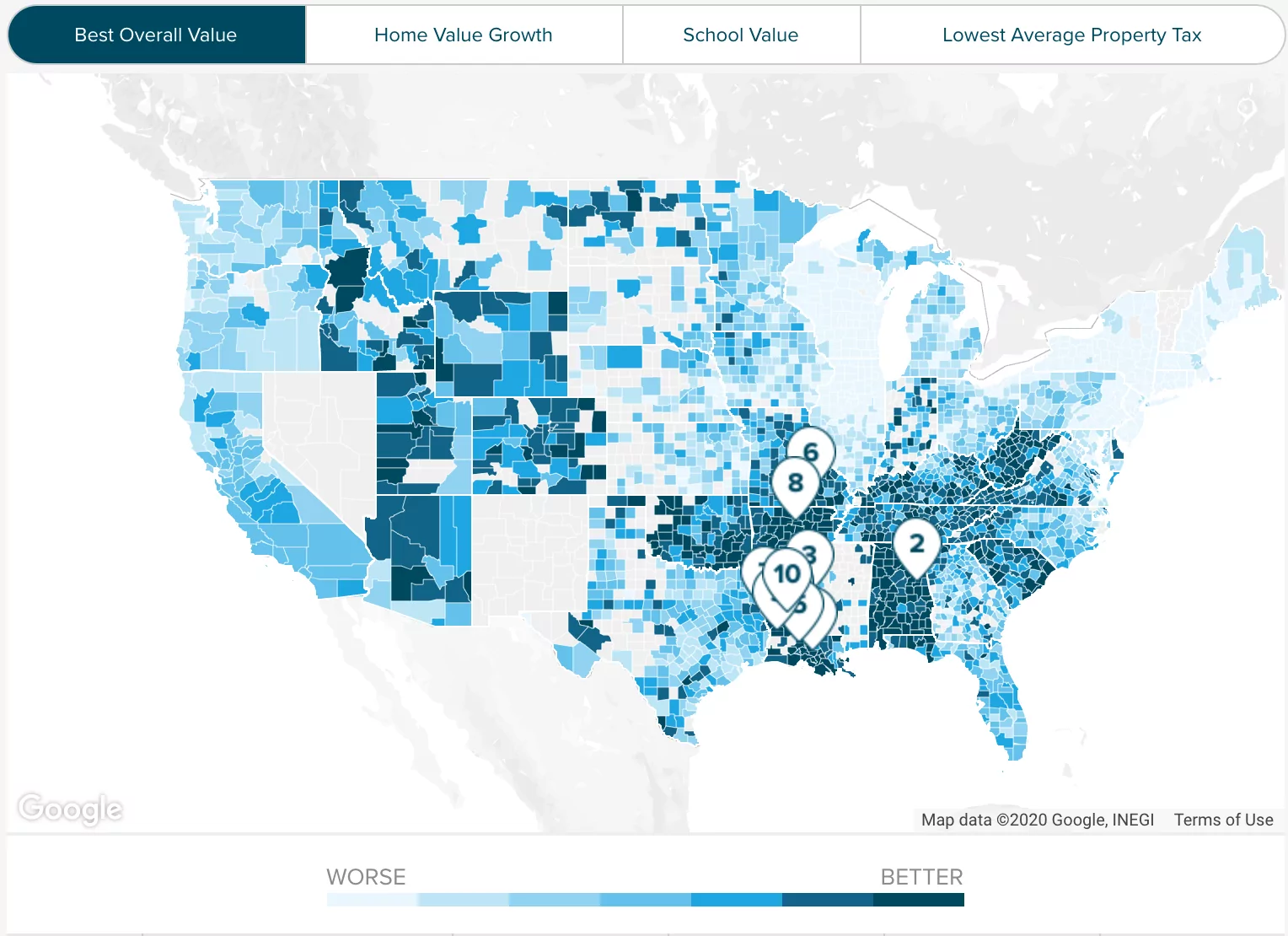

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Michigan Sales Tax Small Business Guide Truic

States With Highest And Lowest Sales Tax Rates

King County Wa Property Tax Calculator Smartasset

Jefferson County Property Tax Getjerry Com

Wisconsin Property Tax Calculator Smartasset

2022 Best Places To Buy A House In Washtenaw County Mi Niche

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation